12 Feb 2024

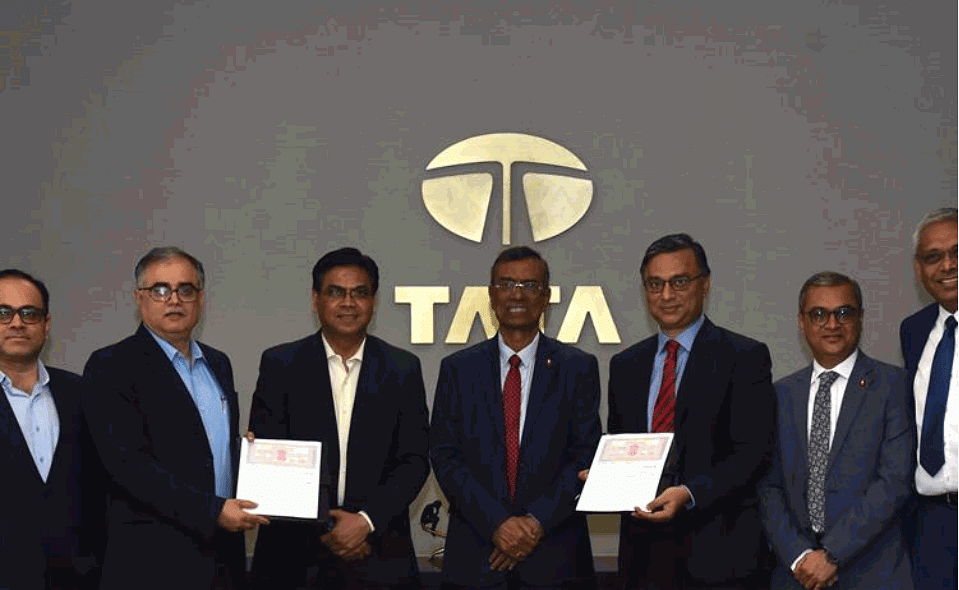

Tata Motors and Bandhan Bank sign MoU to offer commercial vehicle financing solutions

Tata Motors, India's largest commercial vehicle manufacturer, has signed an Memorandum of Understanding (MoU) with Bandhan Bank to offer convenient financing solutions to its commercial vehicle customers.

Review

Tata Motors, India's largest commercial vehicle manufacturer, has signed an Memorandum of Understanding (MoU) with Bandhan Bank to offer convenient financing solutions to its commercial vehicle customers.

Under this collaboration, Bandhan Bank will offer financing across the entire commercial vehicle portfolio and customers will benefit from the bank’s network and its easy repayment plans, noted the press release.

Commenting on this partnership, Rajesh Kaul, Vice President and Business Head – Trucks, Tata Motors, said, "This partnership reflects our commitment to providing accessible and efficient financial solutions, empowering our customers to achieve their business goals with ease. Together, we look forward to driving greater convenience and support for our valued commercial vehicle customers."

Also Read: Tata Motors Partners with UN-Backed LeadIT initiative to strengthen net zero emissions

Santosh Nair, Head, Consumer Lending and Mortgages, Bandhan Bank, said, “We are confident that this collaboration will enable us to extend our reach and provide tailored financing options to support the growth of businesses in the commercial vehicle segment.”

Tata Motors offers an extensive range of sub 1-tonne to 55-tonne cargo vehicles and 10-seater to 51-seater mass mobility solutions, ranging in small commercial vehicles and pickups, trucks and buses segments. It also has a network of 2500+ touchpoints, manned by trained specialists and backed by easy access to Tata Genuine Parts.

The Future of Commercial Vehicle Financing

The collaboration between Tata Motors and Bandhan Bank marks a significant milestone in the commercial vehicle financing industry. As these two industry leaders join forces, it opens up a world of possibilities and potential long-term implications for the future of commercial vehicle financing.

One of the key implications of this collaboration is the potential to inspire similar partnerships in the industry. As Tata Motors and Bandhan Bank demonstrate the power of combining their expertise and resources, other players in the market may be encouraged to explore similar collaborations. This can lead to a wave of partnerships that drive growth and innovation in the commercial vehicle financing sector.

Also Read: Tata Motors introduces 'Karo Life Control Mein' campaign on fleet edge telematics platform

By pooling their strengths, Tata Motors and Bandhan Bank can create synergies that benefit both customers and the industry as a whole. This collaboration can result in enhanced financing options, improved customer experiences, and streamlined processes. It can also lead to the development of innovative solutions that address the evolving needs of commercial vehicle owners and operators.

Moreover, this partnership has the potential to bring about positive changes in the financial landscape for commercial vehicle financing. It can inspire other banks and financial institutions to rethink their strategies and explore new avenues for growth. This healthy competition can ultimately benefit customers, as they have access to a wider range of financing options and competitive interest rates.